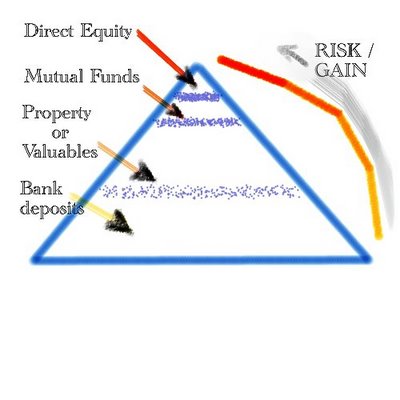

Demonstrated to me by my banker friend Manmohan, at my new company. Fairly self explanatory.

Summarized as follows,

- The chance of higher earnings/profit increases with more riskier investments.

- The moment a person gets better earnings from an investment destination, the risk in investing w.r.t that destination virtually reduces, and it is wise to put in/ transfer more investments to that destination.

- The bulk of investments should be in the least risky of all investment destinations. It is generally better to put money in an investment destination where the principal amount is guaranteed to be returned. Direct equities and mutual funds are therefore not recomended as good investment destinations unless well understood.

4 comments:

Wow,

A banker gave you advice that favors what a banker sells.

Should we be surprised?

If he tells you to research something that does not benefit him - it might be time to listen.

It is interesting in that it partially demonstrates that which option investors typically keep to themselves;

Investing in derivatives like options and futures is actually both less risky and has a higher return as long as it is understood what one is doing.

Allan: Well, in normal circumstances, even I wouldnt trust a banker. Some of them are a league apart though. Hence I consider this advice worth the trust.

iiq: Yes, that's right. Spot on.

thanks for posting this.

Post a Comment